Table of Contents

Retail Loyalty Program Features

Three of the most desired features of a retail loyalty program are monetary rewards, tiers, and rewards options. Details regarding these features have been provided below.

1. Monetary Rewards

- One of the most desired features of a retail loyalty program are monetary rewards. According to a Synchrony Financial poll, 44% of Americans value monetary rewards.

- In addition, according to research by Technology Advice, 57.4% of respondents indicated that the main reason why they participated in loyalty programs is to save money.

- One way to give monetary rewards to customers is through a points program. Awarding customers points that can be redeemed for discounts in future encourages them to be loyal.

- Another way to offer monetary rewards is a cash equivalency that gives customers a flat rate of money after spending a required amount. For instance, every time a customer spends $60, they earn $10 back and can redeemed using vouchers when they go back to the store.

- A monetary rewards feature that either offers rewards points or a flat rate can be used by both online and in-store retailers.

2. Tiers

- A tiered loyalty program is one where customers enjoy different loyalty program benefits based on their rank. Tiered programs rank customers into specific groups based on a given metric. Every tier is defined by different rewards, benefits, and services that increase in value as the customer rises in ranking.

- Tiers help to categorized different types of customers based on their spending. Customers desire to have tiers in a loyalty program because it “makes them feel special. “

- VIP programs help retailers to identify the most loyal customers and reward them. Setting up tiers with increasing benefits helps customers to purchase products more often and in larger quantities.

- A tier system “allows only the most loyal customers access to the top tier, which acts as an incentive to continue spending to gain access to the best rewards.”

- A tiered loyalty program can be applicable to both online and in-store retailers.

3. Reward Options

- Customers prefer to choose their own rewards because it gives them control over their decisions. Therefore, having reward options in loyalty programs is important. Allowing customers to redeem rewards keeps them engaged in each stage of their rewards journey.

- One way to have reward options is to have smaller, entry-level rewards that can be earned often and larger, top tier rewards that are difficult to earn but are worth the wait. Therefore, customers can either opt to redeem their points frequently or save.

- Giving rewards options is possible for both online and in-store retailers.

Retail: Loyalty Drivers

Primary drivers of consumer loyalty to a retailer include trust, personalization, pricing, and aspirations. More details on the drivers are provided below.

1. Trust

- Research done by Loyalty Lion identified trust as one of the drivers that influence customer loyalty.

- Trust is especially a factor when purchasing products online. Consumers need to feel safe that the data they use when shopping online will not be abused.

- It is important to note that customers will trust brands that have sound security protocols.

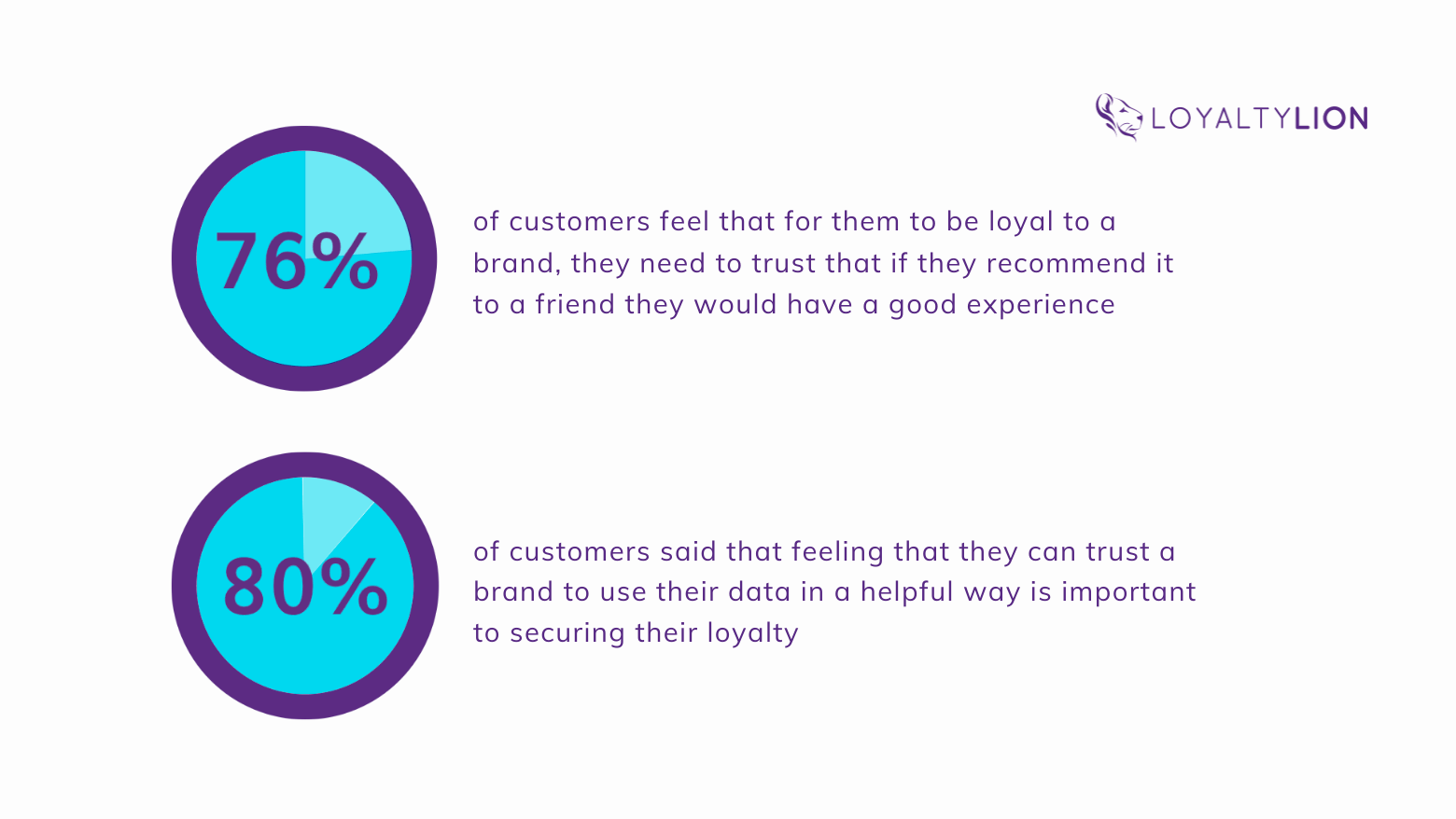

- Furthermore, 80% of customers agreed that being able to trust a brand to use their data in a helpful way is key to securing their loyalty.

- Customers also need to be assured that they could safely recommend a brand to others for them to be loyal. According to LoyaltyLion, for 76% of customers to be loyal, they need to trust that their friend/family will not be disappointed if they recommend purchasing from a retailer or brand.

2. Personalization

- Customerdevoted.com identified personalization as one of the top drivers of customer loyalty. According to them, customers want to feel special.

- This statement is corroborated by Epsilon’s study that found out 80% of customers are more likely to do business with a brand if they were offered personalized experiences.

- Additionally, Loyalty Lions conducted research that showed 78% of customers would want to be recognized and rewarded for their loyalty. 65% said they would be motivated by personalized offers while 61% by personalized product recommendations.

3. Pricing

- Another factor that affects customer loyalty is reference pricing. Price referencing could either be internal or external.

- Internal price referencing involves a price that a customer already expects to pay in his head. It is usually influenced by past buying experiences, discussions with colleagues/friends, and feelings based on expected value. External price referencing involves comparing the price offered with that of a competitor.

- According to Graham Jones, a consultant on internet psychology, customers are more loyal to companies that match their price expectations. He added that customers who know what the company’s competitors are charging are more loyal.

- Lastly, Graham added, “Poorly considered price promotions could disturb this subconscious process, making loyal customers somewhat confused.”

4. Aspirations

- Nowadays, customers are more loyal to brands that provide them with goals or rewards to work towards.

- 74% of customers agreed that working towards a reward makes them loyal to the retailers. Additionally, 79% concurred that the feeling they get when they accumulate reward points makes them loyal.

Retail Loyalty Program Member Demographics

There are about 3.8 billion loyalty program memberships in the US. About 71% of people age 55-64 are most likely to be a member of a loyalty program.

Age

- According to YouGov’s most recent report, about 71% of adults age 55-64 are members of at least one loyalty program.

- Around 69% and 66% of people age 45-54 and 35-44 are members of a loyalty program, respectively.

- About 43% of people age 18-24 are members of a loyalty program

Gender

- According to the YouGov study of US loyalty program members, the female gender is more likely to be a member of the retail loyalty program.

- Nearly 68% of US retail Loyalty Program Members are female, and about 59% are Male.

- Approximately 40% of young male adults ages 18-24 and 30% of ladies in that age range have never subscribed to a loyalty program.

Race / ethnicity

- About 80% of loyalty program members are Caucasian, making them the highest race with loyalty program membership.

- Approximately 10 percent are Asian and, 5 percent are Hispanic and African-American.

- Nearly 24% of Hispanics are more likely than 12% of non-Hispanics to feel the process of filling a membership form is too lengthy. About 31% of Hispanics are more likely than 17% non-Hispanics to be discouraged from signing up.

Income level

- According to research, members of loyalty programs make between 12 and 18% more income than non-members.

- About 24% “of U.S. travelers with an income below $20,000 belong to a travel loyalty program. “

Location

- The states with the most members of a retail loyalty program include Louisiana, Washington D.C., Kansas, Washington, and New Mexico.

- Louisiana is the state with the most members of a loyalty program.

- According to an older source, “the Northeast (70%) and West (63%) have the highest concentration of store or membership loyalty program participants.”

Retail Loyalty Program Trends

Two major trends in the retail loyalty program are mobile apps and premium loyalty programs. Mobile apps are being used to combine rewards with online ordering and other features. Premium loyalty programs are catering to those who want better perks and a feeling of exclusivity. Information about each trend is located below.

1. Mobile Apps

- Mobile apps are becoming more popular with retail loyalty programs because they combine multiple features, such as push notifications, newsletters, and sales, into one location.

- Mobile wallets within mobile apps are also being used, allowing customers to access their loyalty perks right through the app while paying or shopping online.

- According to one survey, 52% of respondents preferred to track and redeem loyalty rewards through a mobile app.

- The main driver of retail loyalty mobile apps is that people simply expect instant gratification and want to access their rewards immediately.

- Using a mobile app also creates gamification, or turning earning points and rewards into a fun activity, and encourages repeat buyers.

- One great example is Starbucks’ loyalty app. It awards gold stars for each purchase which, combined with fun graphics, entices customers to earn more stars to earn a free drink.

- One survey showed that Starbucks’ app is the most popular retail loyalty app, with 48% of respondents choosing it.

2. Premium Loyalty Programs

- In one survey, 80% of Millennials and 68% of non-Millennials said they would join a store’s premium loyalty program to receive better perks and rewards.

- The same survey also showed that 87% of people who were satisfied with a premium loyalty program were more likely to choose that retailer over another, lower priced one.

- Another survey showed that 77% of Gen Z respondents were willing to pay a premium for perks such as free shipping or other rewards.

- Amazon Prime was a big driver in the premium loyalty program trend. This is because people enjoyed getting free shipping in return for a small fee and wanted to see systems like that with other retailers.

- Another driver of premium loyalty programs is a sense of exclusivity, which actually promotes consumers to tell others about the programs they belong to.

- People also use premium loyalty programs because they like the idea of getting perks immediately by paying a small fee, instead of only when they shop.

- One company that uses this model is Lululemon. Their membership is customized to certain cities and offers workout classes and exclusive clothing.

- Lululemon’s program is a success because it combines transactional rewards such as their clothing with fitness rewards, which is what their items are targeted for.

COVID Impact: Retail Loyalty Programs

The impact of COVID-19 on retail royalty programs can be seen with shifting consumer preferences, increasing memberships for paid loyalty programs, growth of online sales, declining brand loyalty, and enhancing rewards programs. Details regarding these features are presented below.

Shifting Consumer Preferences

- According to a recent PDI survey, saving money was the most popular reason for consumers to join a rewards program at 27%. It is followed by earning rewards/points on everyday purchases at 15%, and programs that allowed consumers to earn rewards without changing their behavior at 13%.

- In 2020, the most appealing rewards to consumers were programs that earned points for rewards. It is followed by plans that enabled consumers to get cash-back for their spending, i.e., a $10 bonus for $100 purchase value. The third most preferred program offered consumers a new reward every Monday.

- Fuel savings were the most popular loyalty benefit offered to the US-customers; it fell from 1st to 6th place this year due to the pandemic. In 2020, fewer respondents (32%) earned the fuel savings reward, and 29% of consumers placed the fuel savings reward at the bottom of their lists.

- Alternatively, programs that let consumers earn points across multiple retailers and get surprise gifts on signing up were considered less appealing during the pandemic.

- It is also found that consumers appeared more interested in gamified reward programs, such as tracking milestones at 25%, challenges at 24%, badges at 15%, and leader boards at 12%.

Less Brand Loyalty

- A recent McKinsey study revealed that over 75% of consumers “tried new brands, places to shop or methods of shopping so far during the pandemic.”

- Since the outbreak of COVID-19, about 36.6% of consumers said they shop with more brands than before, and 46.2% said they are now less loyal to the brands they loved.

- According to Merkle Research, about 85% of consumers would like to select the rewards and benefits themselves. Further, about 35% of members would enjoy additional features or tools to find the right product.

Rise of Paid Loyalty Programs

- According to McKinsey, a trend toward shifting from points-only loyalty programs was already underway before the pandemic. Alternatively, paid loyalty programs gained a significant threshold to attract new customers and offer long-term value in consumer loyalty during the pandemic.

- McKinsey’s recent survey on loyalty programs found that 60% of paid loyalty program members are likely to spend more after subscribing to a brand. In comparison, free loyalty programs increased the likelihood of 30%.

- It is noted that paid loyalty programs result in 43% more weekly purchases, 62% higher brand spending, and 59% increased brand affinity than free loyalty programs. Thus, brand subscribers are worth several times more than non-subscribers.

- In 2019, US-consumers spent about $25-$30 billion on paid loyalty programs, registering a growth of 25% to 50% from the previous year.

- According to Clarus, the premium loyalty program’s enrollment grew by 21% year-over-year from April-July 2019-2020. Additionally, about 70% of premium loyalty members plan to join another premium loyalty membership in 2020.

- It is found that 94% of premium loyalty members shopped at the membership store at least once a month. Moreover, about 88% of consumers prefer a premium loyalty program over a competitor’s lower price offerings.

- Perks that motivate consumers to join a paid loyalty program include free shipping 66%, instant discounts 60%, free giveaways 56%, and faster shipping 47%.

Growth of E-Commerce Sales

- In the second quarter of 2020, the e-commerce revenue soared to 71%, compared to the same period in 2019. Additionally, most categories witnessed an increase of 15% to 40% in user growth across online channels. Moreover, about 35.1% of shoppers planned shopping online more often than they did before the pandemic.

- Vivek Pandya, Adobe’s Digital Insights Manager, said that “It would’ve taken between 4 and 6 years to get to the levels that we saw in May if the growth continued at the same levels it was at for the past few years.”

- Online purchase of grocery, personal care products, alcohol, furnishings & appliances, household supplies, and OTC medicines increased by 30%-49% post-COVID.

Personal Information Sharing

- According to Merkle’s research, consumers’ willingness to share personal information to customize the reward experience has decreased over the past 9 months.

- Consumers allowing brands to use personal information like purchase history (52% vs. 59%), rewards status (49% vs. 56%), household income (19% vs. 21%), and gender (49% vs. 52%) has decreased since the pandemic started.

Enhancing Existing Reward Programs

- Major brands like Sephora, Kohl’s, Michaels, and Madewell enhanced their loyalty programs to drive repeat purchases, maintain customer bases, and provide enticing incentives.

- Michaels craft store reward program was updated to allow customers to earn weekly rewards from purchases and receive seasonal bonus offerings.

- Madewell revamped its loyalty program by launching a point system for shoppers. It enables customers to receive a $10 reward on shopping for $250.

- Sephora’s new loyalty program offers shoppers exclusive options like Beauty Insider Cash, expanded makeup sampling, free shipping, and early access to product launches.