NFC tags are gaining traction in the United States despite still lagging behind Europe and Asia. Knowing that consumers are more likely to enjoy and value experiences powered by NFC tags than QR codes or Beacons, retailers and brands leverage the technology to achieve personalization and unparalleled experiences, particularly fashion and alcoholic beverage companies. They employ best practices such as pairing NFC tags with other proximity marketing technologies while observing limitations and ensuring customers derive actual value from their experiences through gamification and practical features. Unfortunately, not many home improvement brands adopt NFC tags for marketing purposes, typically limiting their use to payment solutions. A detailed explanation of how this fact was determined was provided at the end of the report, in the Research Strategy section.

Table of Contents

Consumer Insights

- A 2020 survey conducted with over 2,000 consumers worldwide, including 500 from the United States, reported that the United States has “lagged behind in most areas but is now catching up rapidly,” with consumers increasingly embracing NFC. Eighty-eight percent of respondents reported a consistently positive experience with NFC technologies. “Adoption of contactless technology is surging as consumers look for convenient, secure, and safer ways to pay, unlock, access transportation and connect with the world around them.” stated Mike McCamon, executive director at the NFC Forum.

- Blue Bite, a company specialized in connected technologies, examined the activation rates of its NFC smart products and discovered a “16% growth in NFC activations from 2018-2019, with a 44% growth in interactions. This clearly shows consumers are interested in interacting with smart products often. This equates to a 13% growth in the number of interactions per active object and a 27% growth in total smart product reach.”

- A study released in 2015 asked US-based consumers to evaluate and compare their experience with NFC, QR code, and Bluetooth Beacon solutions in various in-store retail scenarios. The research was conducted in two phases. In the first one, they conducted real experiments with 36 participants in multiple real retail settings to “further understand consumer perceptions around usefulness, usability, and security — and how compelling these are to consumers.” These results were then validated with an online survey of 1,038 consumers in the US. Despite being older than desired, this study provides an in-depth and unique look into the consumer experience:

- Seventy-six percent of participants stated they were very satisfied with their experience with NFC, as opposed to 53% who said the same regarding QR codes. Seventy percent said that “NFC technology addresses real-world problems and inconveniences.” Several participants pointed out that not having to open an app to use the technology improved their experience.

- “Participants preferred NFC’s user-initiated ‘pull’ approach to retrieving information compared to the ‘push’ approach from Bluetooth Beacons. They felt the pull allowed greater control over what information they received and greater accuracy of that information. Consumers value credible information, especially when researching purchases on the go. “

- The study presented different scenarios and asked consumers how interested they would be in using NFC and how they believed it would improve their shopping experience. Seventy-four percent said they would be interested in using NFC to access store deals, Wi-Fi, and reward or loyalty programs. Moreover, 67% “of respondents found this type of retail experience valuable to them, and 28% of respondents indicated this experience made their shopping experience much more valuable.”

- Seventy-seven percent said they would be interested in accessing more product information & store Inventory, and 45% would be very interested in having this experience at their favorite retail shops. Thirty-two percent of respondents “indicated this experience would make their shopping experience much more valuable, with a further 37% saying it makes it somewhat more valuable. Most notably for retailers and brands, study participants showed the greatest interest in getting more product information (e.g. shoe colors available, 82%), and checking stock levels (81%) using NFC in this scenario.”

- Sixty-four percent of respondents indicated “some level of interest in using NFC to learn related product and brand information (e.g. recipes), while 34% were very interested in having this experience at their favorite retail shops. 59% of survey respondents found that using NFC to gather related product information was valuable to them, and 29% of respondents indicated this experience makes their shopping experience much more valuable.”

- Respondents showed the “greatest interest in applying store or brand coupons and/or rewards to purchases automatically using NFC in this type of scenario (83%). Additionally, 68% indicated “some level of interest in using a digital shopping cart/quick NFC checkout and having receipts stored digitally. “

- Participants were asked to “assess the efficiency and helpfulness of using NFC technology to gather more product information about a large, expensive, and/or high-involvement retail item that would be seen as a major purchase (such as a washing machine).” Seventy-three percent indicated some level of interest, while 39% said they would be very interested.

- Sixty-eight percent said that “using NFC to gather more product information when shopping for large items valuable to them,” and 33% said it would make their shopping experience much more valuable. The majority of respondents “agreed that being able to access on-the-spot product and brand information, such user reviews, videos about new and innovative features, and consumer reports, is useful when making large purchases.”

- Furthermore, 45% said they would be interested in NFC being used to “tap a product they own and order exact replacement parts/accessories for it,” and 39% said this would make their shopping and brand experience more valuable.

- An experiment conducted by News America Marketing, Kraft, and SmartSource discovered that consumers were 12 times more likely to engage with NFC tags than QR codes placed on store shelves. More than “36 percent of shoppers who tapped the NFC-enhanced shelftalker converted into an action, such as saving a recipe, downloading the Kraft app or sharing with friends.”

- Another study reported that consumers tested in five in-store retail scenarios were eight times more likely to prefer NFC over Bluetooth beacons. For example, Pernot Ricard achieved mobile engagement rate of 4% using NFC tags versus 0.5% with other digital channels.

NFC Alternatives

QR Codes

- QR codes are the most common alternatives. The consumer scans the QR code and the smartphone interprets it, leading to a related website or application. “To use a QR code, a business decides what they want the code to link to and uses a computer program to generate the image. Printing the image onto advertisements or displays makes it available to the public.”

- QR codes are not versatile. While NFC tags can be reprogrammed, QR codes cannot be changed once generated. They rely on good lighting conditions, require an app, are not secure, and are more susceptible to damage. They also tend to be more limited to the pre-purchase and sale phases, not having as much lifecycle endurance as NFC tags.

- Nonetheless, they possess widespread adoption and awareness. Consumers in the US understand how they work, most phones are able to read them, and they are compatible with multiple apps. Comparing to NFC tags, QR codes can be read from a longer distance. They are also a cheaper option and are easily recognizable.

- “IKEA makes check-outs for large furniture easier with QR based mobile check-out option. For a store like IKEA that sells furniture of different sizes, it is a huge challenge to take the products to the check-out counter and scan them. IKEA came up with a simple QR code-based solution to this problem by introducing the scan and check-out feature.”

![]()

- Home Depot is another big retailer that uses QR codes to engage customers. The company has “deployed hundreds of codes from the platform on media like newspaper circulars, in-store signage, local events, and more. Each of the codes link to relevant content based on the product the customer is scanning with options like video demos, useful tips, and even an option to ‘buy it now.’” Additional content includes reviews and product information.

SnapTags

- SnapTags are scannable 2D barcodes, similar to QR codes; however, this technology turns images into a barcode. “Whether it’s a logo or special icon, SnapTags will surround the image with a “code ring,” a black-and-white ring with dots that can be configured into thousands of combinations and unique codes. Users can either scan the SnapTag with their app or take a picture and text it to a designated number, which will reply with the marketing message.”

- Regardless of the name, SnapTags are not part of Snapchat (that would be Snapcodes). They were invented by Spyder Lynk.

- SnapTags allow better product design and have the potential to “reach a wider audience, namely those without smartphones or reader apps, because SnapTags can be accessed via a normal camera although it still requires that users do an action (text or email) to activate the code or that they download an app.” Content can be changed or reused.

- SnapTags’ adoption and awareness rates are inferior when compared to QR codes. They were released in 2011, and unlike NFC tags, there are no indications of increased used over the last two years.

Pincodes

- Pincodes were added to the list due to early adoption by home improvement brands. However, it is unclear if these brands are still using Pincodes in the United States.

- Pinterest’s Pincodes function similarly to QR Codes and SnapTags. However, in order to read a Pincode, customers must use Pinterest Lens to scan it, which could be viewed as a negative point. Additionally, it does not seem to have high adoption rates in the United States.

- Creating Pincode is easy and cheap. Companies must log into their business account, click on the board, select Create a Pincode, customize the image, click on Download Pincode, and share or print the code. Like QR codes, they are also vulnerable to damages.

- Pincodes direct customers to companies’ Pinterest boards. For example, Nordstrom used Pincodes to direct customers to the board of “Gifts under $100,” while Kia created a “Pincodes display at the Los Angeles Auto Show to showcase design features for the all-new 2018 Kia Stinger.”

- A Pincode is colorful ring that surrounds an ad image. This image is customizable.

- Home Depot was one of the early adopters. However, visuals are only available in Spanish.

- UK Furniture store Neptune also adopted the technology.

- Fiona Strang, Marketing Director at Neptune, said, “Our customers really engage with the content from our own Pinterest boards as well as those from other brands, other magazines and other users. Our Pincode has been a really valuable and interesting test to see how Livingetc readers respond to the new technology. It’s been a great success.”

Image Recognition

- Imagine recognition is a “subset of computer vision.” It can be used to analyze consumer behavior and to create engaging experiences. The purpose of image recognition is “similar to that of computer vision, i.e., to automate the performance of a task. In image recognition, these tasks are varied. For instance, they can be the labeling of an image through tagging, the location of the main object of an image, or guiding an autonomous car.” Considering the purpose of this report, the only functions examined will be the ones that are comparable to NFC tags.

- Some stores use image recognition to provide “scan-to-shop” in-store experiences. For example, Nordstrom created shoppable style guides, lookbooks, and catalogs. “The tools empower customers to browse products across all their devices — and to make purchases from images and video in one click.” These digital catalogs resulted in a 164% increase in average order value compared to Nordstrom native app.

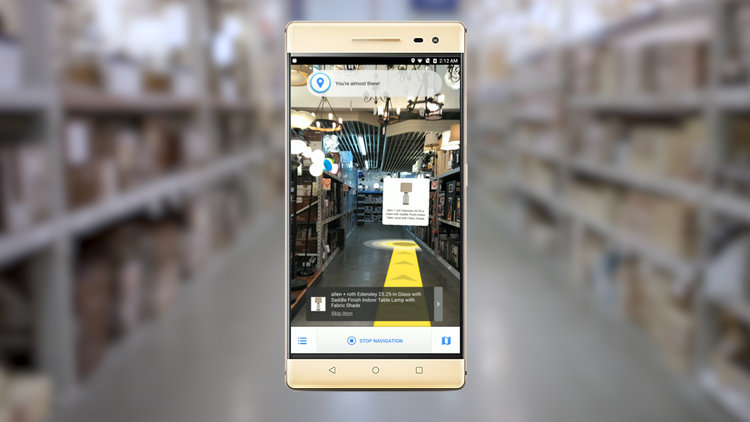

- House of Blue Beans is “using CG content to build shopping experiences based on AR/VR and image recognition” for Lowe’s. The retailer also partnered with Google to use computer vision to give consumers “turn-by-turn digital directions to the product they need using the most efficient route.”

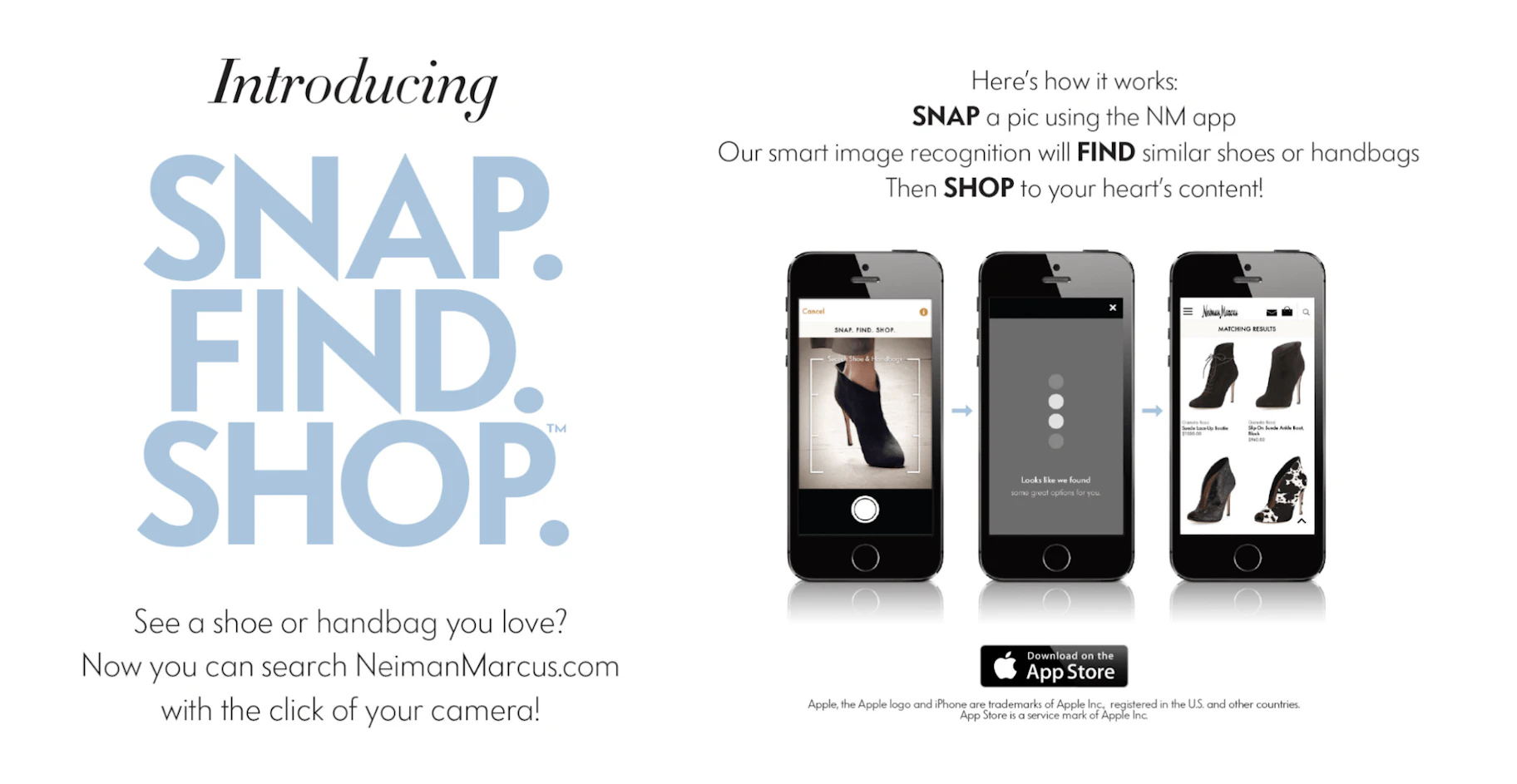

- Neiman Marcus created the “Snap. Find. Shop.” App. “Whenever users see a pair of shoes or handbag they like, they can use the app to take a photo, which is then used to search the Neiman Marcus database using smart image recognition.”

- Image recognition can help customers visualize possibilities, such as how a certain furniture piece would look in their living rooms. At the same time, these technologies are complex to implement and usually expensive. Additionally, there is controversy surrounding computer vision, AI, and data and privacy concerns.

Bluetooth Beacons

- Bluetooth Beacon technology allows “mobile apps to listen for signals from beacons in the physical world using Bluetooth technology and act accordingly. They deliver hyper-contextualized content to users based on their location.”

- In 2017, Target added indoor mapping powered by beacons to improve customer experience and engagement. The feature, “GPS for your shopping cart,” shows customers their real-time locations and if they are closer or farther from the item. When consumers are near one of the stores that carry this technology, they are prompted to opt-in to share location and receive notifications. Target promises that they’ll “only send two notifications per shopping trip, so customers aren’t annoyed and overwhelmed. These will include special deals and discounts.”

- Beacons have a 50 m range versus NFC’s 4 cm. They can push content actively, while NFC need to be triggered by the consumer; however, this could be viewed as intrusive by consumers.

- They are more expensive to implement than NFC but are not disposable. They require battery management and are vulnerable to signal interference.

Companies using NFC Technology – Successful Case Studies

Mammut

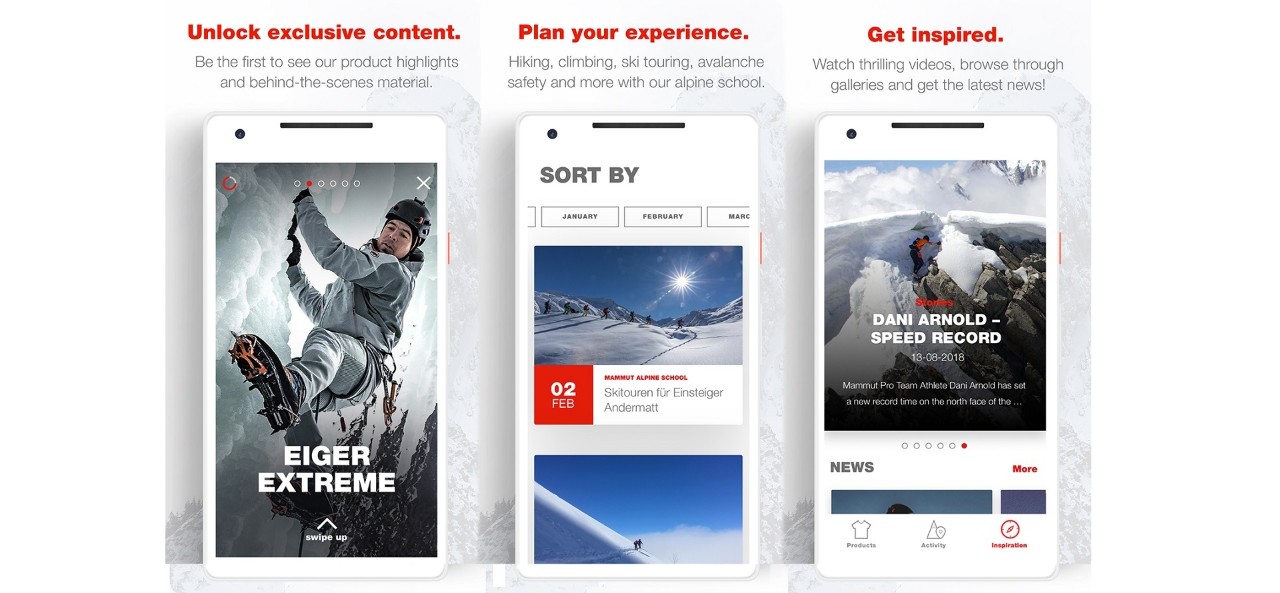

- Mammut Sports is a retailer specializing in apparel and equipment for outdoor activities, with multiple stores worldwide. The company partnered with Smartrac to help “customers transform for the digital age.” At NFR 2019, the premium outdoor brand presented its first “NFC-enabled products and the corresponding smartphone app Mammut Connect.”

- “When a smartphone is tapped on a product’s NFC touch point, the app delivers digital content and services to customers throughout the product’s lifetime, as well as supporting retail channels with in-depth product information to enhance the sales process. All NFC-enabled Mammut products come with embedded Smartrac CircusTM Flex NFC tags, equipped with an NXP NTAG 213 IC. These tags are specifically designed to resist harsh environments and have passed a very strong acid test as an integral part of their value proposition and a requirement to fully support long shelf life.”

- Mammut released videos to show clients how to use the Tags and the app. “The Start Your Adventure” video is available here. Another video showing how the Tags work and the content customers see when they scan the tag is available here.

- Consumers could access product information and services in the app, such as “warranty extension, videos and stories that enable virtual brand experiences.” They could also access “exclusive invitations to outdoor events in cooperation with trade partners.” Content revolved around how-to videos, new launches, consumer stories, and photos.

- The app achieved good adoption rates, reaching more than 30,000 users in a short period. Tracy Bull, Head of Consumer Insights and Connectivity, declared, “We are definitely achieving what we intended to achieve. We are happy with how well the app has been received in our customer community and have gained a wealth of insight that we never thought possible.”

- The company announced it is pausing the app in October 2020. However, it is important to note that the change is not necessarily connected to the success of the tags. Conzzeta, Mammut owner, stated in its Half-Year Report 2020, that Mammut was severely hit by the pandemic and physical sales dropped significantly. It is now taking measures to mitigate the financial impact, saying “the allocation of resources available must be prioritized even more clearly.” The company is also more focused on direct-to-consumer sales now.

Chambers’ Apothecary

- Chambers’ Apothecary is a compounding pharmacy, located in Pennsylvania. It “prided itself on delivering an extraordinary degree of customer service. But with thousands of alternative health products for sale, the challenge for Chambers has been to provide expert advice to customers on all of those products.”

- As a small business, it does not have the same financial resources or staff members as other entries on this list. “Chambers has a lot of natural products and vitamins, and customers are always asking questions about them,” said Janelle DelSignore, Purple Deck’s Marketing and Sales Manager. ‘They want to know, ‘What will this do for me?’ There’s not enough room on the product labels to explain all the benefits.”

- The solution was installing small, self-adhesive tags on shelves and encourage consumers to tap the tags with their smartphones. “The tags, provided by Purple Deck, can be managed and updated remotely, thereby simplifying mobile content delivery.” Since the tags can be reprogrammed remotely, they do not need to be removed or replaced individually.

- This video shows how the tags look and work in-store.

DYNE

- DYNE is a US-based men’s luxury athleisure brand. The company provides a mixture of fashion and technology, aiming to achieve “the perfect marriage between fabric, fit and function.”

- Since the clothes’ value is related to the fabrics and technology involved, DYNE wanted to communicate to customers and retailers “the philosophy behind each garment, the materials used and the brand identity, but found it challenging to easily relay the information to them. This led to difficulties in selling DYNE’s collection as retail employees were not equipped with the knowledge to explain to customers what made the pieces so valuable.”

- It partnered with Blue Bite and each piece was embed with digital identity. “The NFC chips were embedded in each garment underneath the DYNE logo, symbolically demonstrating that the experience comes from the brand. The chips’ strategic placement also established a direct connection with customers when they tapped the logo with their phone to reveal the digital experience.”

- When consumers tapped the logo, they had access to the full line, allowing them to browse and buy new pieces on the spot. Each garment had a “specially curated Soundcloud playlist to enhance the experience of owning a DYNE item, and live social feeds like Instagram, Twitter, and Weibo so customers could remain up to date on the brand in real-time.”

- Blue Bite commissioned Forrester Research to examine the results. Some highlights:

- Implementation costs were around $70,000. However, Forrester explains that costs are deeply related to brand size, and most companies should expect a 50% higher cost. DYNE paid $0.5 per chip/garment and $13,750 per campaign.

- Forrester’s financial analysis shows that DYNE “experienced benefits of $280,517 over three years versus costs of $87,815, adding up to a net present value (NPV) of $192,702 and an ROI of 219%.”

- Including NFC tags enabled DYNE to see real-time metrics such as repeat use, product activation percentages, and experience interactions. As such, the company discovered that “10% of products had been activated, and repeat usage grew by 40%.” Furthermore, website traffic increased by 250%.

Kraft Heinz

- Kraft Heinz leveraged NFC tags to drive consumer engagement pre- and post-sale during the launch of their new line of salad dressings at Walmart. The company did not want the new line to get “lost in a sea of similar offerings,” said Josh Burns, associated director of shopper marketing for the company’s Walmart team. “Getting a brand new item with only a few facings to stand out seems like an insurmountable task,” he added.

- Kraft added NFC tags to the package and a discount coupon. When consumers tapped on the package label before tearing off the coupon, they received a Kraft Singles recipe on their smartphones. After purchase, “opening the package and breaking the tamper loop in the NFC tag enables a second tap experience. The shopper is invited to play the ‘Find the KRAFT Golden Singles’ scratch-and-win style mobile game and is given an opportunity to earn a $50 Walmart e-gift card at each participating store.”

- The experience was managed by TPG’s Tap Technology. “In an easy to follow process, the consumer swipes their finger across their screen to reveal either a winning tile or a “Try Again” option that includes a link to dynamic KRAFT Singles recipes. These recipes change based on location, day of the week, and social media trends. The tap-and-go NFC label is compatible with Android mobile devices and Apple iPhone 7 or newer (with the latest operating system).”

- TPG’s John Galinos further adds, “The NFC chip that we deployed for the Kraft program was unique as the content that the consumer received changed based upon if the package was sealed or opened. It remains at this point the largest consumer-facing NFC based program Worldwide.”

- Videos showcasing the experience are available here and here. These additional videos show the in-store experience.

Jimmy Jazz

- Fashion brand Jimmy Jazz reinvented its in-store experience and loyalty program using NFC technology. The brand wanted to encourage consumers to enroll in its loyalty program.

- A large TV screen was placed at the flagship store’s shop window and fitted with NFC technology to “enroll customers from the street.” The screen “constantly looped an awe-inspiring animation, tempting people to touch their phones to the screen. When they do so, the screen changes, congratulating them — which is positive reinforcement. Simultaneously, the NFC tag instantly loads up the loyalty program enrollment page to the user’s phone.”

- The brand’s loyalty program is powered by Antavo’s “Loyalty Experience Kiosk,” which has a tablet connected to an NFC reader and sensors. “When loyalty members place their smartphone on the kiosk, they’ll be logged into their profile instantly — or redirected to the enrollment page if they aren’t a member yet. This is quite magical in itself, but the true experience starts here: by interacting with the tablet, customers receive real-time feedback on their phone, since the device is capable of two-way communication.”

- The program includes features such as Prize Wheel, personalized product catalog, product information, real-time sync with store inventory, treasure hunt, and facial recognition. It is unclear how many of the features provided by Antavos are actually part of Jimmy Jazz’s loyalty program.

NFC Tag Best Practices

Best practices were chosen based on industry reports, opinions of experts, and evidence from brands achieving success using NFC tags.

Best Practice #1: Paired Technologies

- NFC is gaining ground. However, it is essential to consider that not all smartphones are able to read NFC tags, and not all consumers understand how these tags work. Therefore, NFC technology should be paired with other alternatives.

- A popular combination is providing an NFC tag and a QR Code. According to a report released by the RFID Journal, this is a powerful combination since “all smartphone users will be able to access content, regardless of the technology being used.”

- McKinsey’s model retail store, The Modern Retail Collective, uses a combination of NFC, RFID, and AR to create the ultimate consumer experience.

- The consulting firm notes that technology alone is not enough. Associates must be trained to encourage tech usage and pick up cues to influence shoppers and drive engagement.

- Apple’s latest wayfinding designs “emphasize scannable tags that help customers spend less time waiting and act as field guides to the store.”

- Nordstrom created an OOH campaign using NFC tags and QR codes. Aligning with Fashion Week, the retailer placed multiple NFC tags around New York to inspire consumers to get fashion looks on a budget.

- The posters, placed in locations such as the subway, included an NFC tag, a QR code, and an outfit photo. When consumers tapped the tag, they were directed to a website containing a video of the look, product information, and shopping directions.

Best Practice #2: Added-Value

- There are a few rules companies should follow to achieve the full potential of NFC tags. For example, NFC tags are discrete and can go unnoticed by consumers; therefore, adding a clear call to action with an explanatory sentence on the tag’s operation is imperative. When placing a tag, companies should keep in mind the distance constraint since consumers need to be extremely close to tap the tag (4 cm).

- Choosing the right type of tag for “each diffusion context” is also essential.

- However, the number one priority should be offering real added value to the customer; otherwise, what should be a great experience quickly turns into disappointment and a drop in engagement. Furthermore, one of the main points of NFC tags is how easy they are to use; ruining that experience by making the application or content complicated or forcing customers to jump to too many hoops is counterproductive. Content and features should be mobile-ready and intuitive.

- The NFC campaign should be targeted. The company needs to understand its customer to ensure what they are presenting makes sense. Consumers who use in-store technology expect the experience to be simple and easy to navigate. According to McKinsey, these consumers can be divided into three segments:

- Full-service experience (5%): These consumers want and need assistance throughout their entire tech journey. This includes “overview of the tech activation, a demonstration on how to use the technology, and support throughout the customer’s session. These customers wanted to see the technology in action but wanted the associate to use their own device or the associate to drive the technology engagement directly.”

- “Help me only when I needed it” (45%): This group wants to be shown what to do and occasional check-ins. They usually only look for associates to answer questions. However, they are more likely to get annoyed by technical glitches, and it is important to have an associate available to help on demand.

- “Just need a nudge” (50%): The larger consumer group enjoys self-service. They are comfortable using technology, and benefit from “small nudges upfront to explain or show the technology—but the store associates only needed that conversation once.”

- To provide value to the clients, brands can leverage multiple features related to sales and products, such as discounts, mobile showcases, access to loyalty programs and rewards, product information, and store locator.

- Another interesting use is to drive engagement with gamification in the form of Quizzes, treasure hunts, game contests, raffle draws, among others.

- NFC labels can also be used to enable AR experiences. Apps can be used to provide “a customer journey that goes beyond purchase via storytelling, special sale offers, recipes, instructions, games, direct interaction or loyalty programs, to name but a few. It’s all about pushing the brand-to-consumer experience a bit further and into another realm.”

- Lifestyle and Footwear brand Staple Pigeon celebrated its 20th anniversary by creating a scavenger hunter powered by NFC. Customers who bought a keychain were taken on a journey throughout New York, stopping at 20 different locations that shaped the brand’s identity.

- At each location, the keychain acted as a key to unlock content that gave access to videos of the brand’s creator explaining why the location was significant. The journey also included prizes, discount promotions and ended with a tour of the Staple office. The experience generated 3,000 interactions and 400 unique users.

- Jameson Irish Whiskey’s annual St Patrick’s Day limited-edition bottles included NFC tags that allowed consumers to “tap to design their own custom label and enter a competition to win a personalized limited-edition bottle.”

- Moët Hennessy created “NFC-enabled Private Access Cards that activate a Blue Bite-powered digital experience that provides users exclusive access to events and product recommendations. These invitations and recommendations change within the experience, dynamically, depending on events available and the consumer’s previous engagement history to provide a personalized experience.”