With the COVID pandemic impacting all areas of life for countries across the world, investors need to establish new strategies for their money. This is true for both personal and institutional investors. Four trends that will impact the investment space post-COVID are increased ESG investing, changing consumers, economic uncertainty, and big government. A description of these trends and what their impact may be on investments going forward have been provided below.

Additionally, the report from B of A Securities titled ‘Covid-19 Investment Implications Series: The World After Covid Primer’ provided five themes that will impact investors: geopolitics and globalization, tech war, big government, health, and the new consumer. We focused on the themes of tech war and the new consumer (specifically Gen Z). The information provided in the B of A report was summarized, and additional research on the topic was also added for a well-rounded view of the topic.

Table of Contents

Trends Related to COVID

1. Increased ESG Investing

- Multiple sources agreed that the COVID pandemic is likely to have a large impact on the ESG investment landscape. These sources include J.P. Morgan, Barron’s, Principles for Responsible Investment, Raconteur, and Financial Times.

- “J.P. Morgan polled investors from 50 global institutions, representing a total of $12.9 trillion in assets under management (AUM) on how they expected COVID-19 would impact the future of ESG investing. Some 71% of respondents responded that it was “rather likely,” “likely,” or “very likely” that the occurrence of a low probability / high impact risk, such as COVID-19, would increase awareness and actions globally to tackle high impact / high probability risks such as those related to climate change and biodiversity losses.”

- Barron’s reported, using data from a paywalled Morningstar report, that in the second quarter of 2020, “sustainable fund flows in the U.S. continued at a record pace of $10.4 billion, bringing net inflows for the first half to $20.9 billion, compared with the $21.4 billion of net inflows for all of 2019.”

- At the end of 2019, 36% of surveyed investors had fully integrated ESG into their investing, while that number is now 51% (based on information published in July 2020).

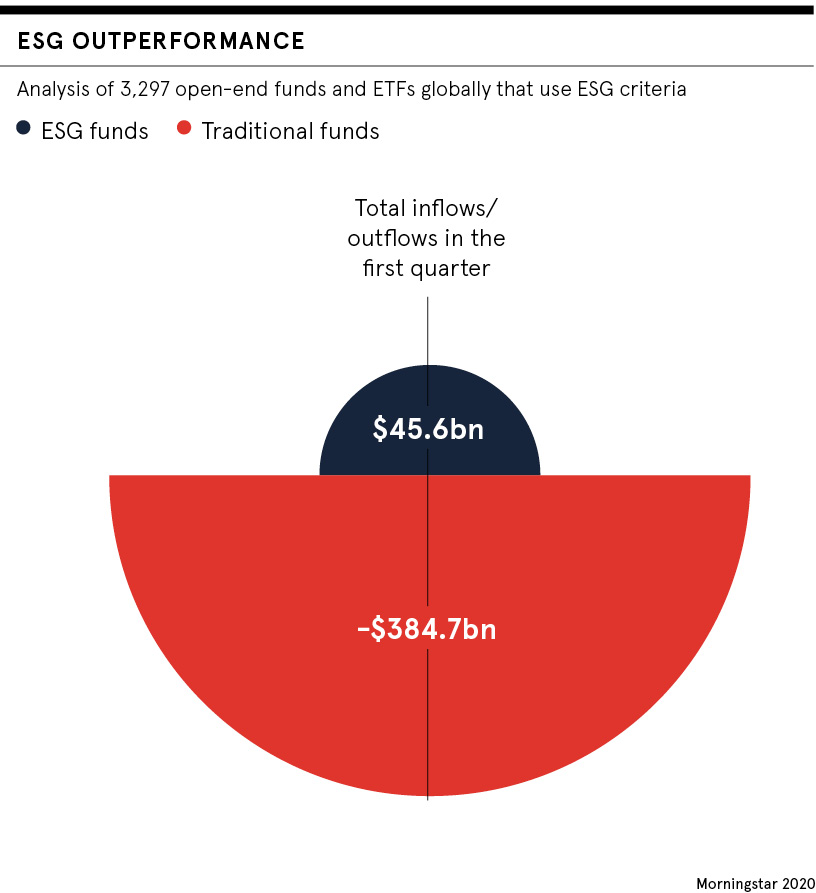

- In the first quarter of 2020, an analysis by Morningstar of investments in ESG funds compared to traditional funds found that ESG funds had positive inflows, while traditional funds did not.

- “According to Blackrock data, 88 percent of sustainable funds in their analysis outperformed their non-sustainable counterparts in the period 1 January to 30 April 2020. Meanwhile, Morningstar reported 51 of their 57 sustainable indices outperformed broad market counterparts in the first quarter of the year and MSCI reported 15 of their 17 did the same.”

- Blackrock stated in their report that “this period of market turbulence and economic uncertainty has further reinforced our conviction that ESG characteristics indicate resilience during market downturns.”

- Reporting in the Financial Times indicated that Blackrock had announced in January 2020 that sustainability would be at the heart of their investment strategy. Although this was prior to COVID being widespread, it showed a leading investment firm being committed to the strategy. In May, Blackrock made clear that the pandemic had only increased the appeal of ESG investing, stating “During the past few months, we have seen that regardless of industry, strong sustainability characteristics have been essential to helping companies weather the crisis, and investors have increasingly sought out sustainable investment strategies.”

- Although McKinsey did not provide the specific names of investors, they did report that in discussions with “with CEOs, CIOs, and other senior executives at 21 of the world’s leading investment institutions,” they found that while these investors were already committed to ESG prior to COVID, several indicated plans to maintain or even accelerate their ESG strategy.

2. Changing Consumers

- Many experts agree that COVID will have a long term impact on consumer behavior. This trend was examined by PNC Insights, Seeking Alpha, the Motley Fool, J.P. Morgan, and Refinitiv.

- There are a number of possible changes to consumer behavior that can impact the investment landscape including more online shopping; decreased spending on experiences; a shift to “natural, healthy, and trusted foods;” long term shifts to working from home; and shifts back to car ownership.

- Ecommerce has grown fast during the pandemic and experts believe that this change will remain and even accelerate post-pandemic. While this trend will obviously benefit online retailers such as Amazon, it will also benefit other businesses that produce equipment to make warehouses more automated and efficient. The following chart shows the change in stock prices for several companies involved in the robotics and automation industry.

- Investors should also recognize the types of consumer products that have benefited from the pandemic, such as personal care, food, and spirits. With the working from home trend expected to continue, many of these categories will continue to see improved sales as consumers’ needs change when they are spending more time at home. While sales in many categories have declined since they peaked earlier this year, sales are still higher than they were pre-pandemic.

- COVID has highlighted the importance of health for many people, and some experts are predicting this will result in consumers buying “trusted brands, organic and fresh foods, and to some extent, vegan foods.” The other side of this could be they purchase less processed and unhealthy foods.

- PNC Insights predicts that post-COVID economic activity will likely reach 85-90% of pre-COVID levels. The missing 10% or so would come from public transportation and air travel, sectors that may not fully recover. The question is whether the decrease in spending in those areas will result in increased savings by consumers or whether they will shift that spending to other discretionary items.

- Early data from China, one of the first countries to see recovery from the pandemic, indicate that car sales are up after the pandemic. This is likely because public transportation is no longer appealing due to fears of infection.

- The shift toward working from home will impact several industries if it continues after the pandemic, as many experts expect. Inner-city real estate could see a decline, public transportation would continue to take a hit, and cybersecurity would see a boost.

- H Venture Partners hosted a webinar on changing consumer behaviors and discussed how their investment focus has changed post-COVID as they account for these changes.

Trends Related to Economic Shifts

1. Economic Uncertainty

- In June 2020, the World Bank published a report titled ‘Global Economic Prospects,’ which discusses how COVID will result in “the deepest global recession in eight decades.”

- Many top players in the investment space are reporting on the impact this economic uncertainty will have on investments, including Investment Executive, Wells Fargo, Morgan Stanley, Fidelity, and Kearney.

- The International Monetary Fund (IMF) projects that global output will increase by 5.2% in 2021, a decrease from their earlier projection of 5.4%.

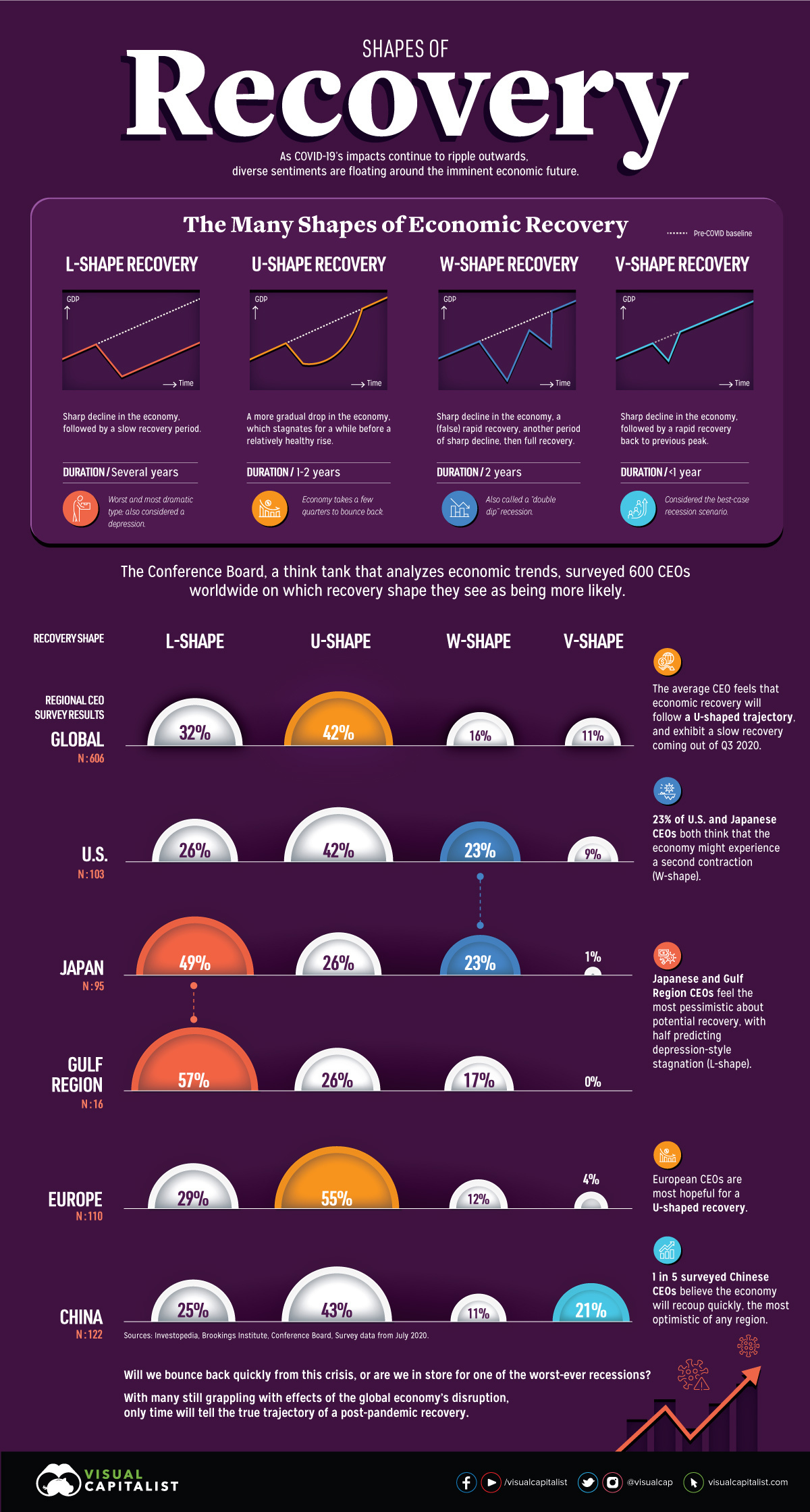

- There is much uncertainty about which path the global recovery will take. A survey of 600 CEOs found that 42% of respondents think an u-shaped recovery is most likely, while 32% believe it will be L-shaped. This lack of consensus leads to much uncertainty as a U-shaped recovery would be expected to take 1-2 years, while the L-shaped path would take several years.

- Lisa Shalett, Chief Investment Officer of Wealth Management at Morgan Stanley, recommends a wait and see approach to investing. She states the four areas to watch in order to have a better picture of what is happening with the economy are Fed policy, trade friction, currency moves, and geopolitical risks.

- With policy questions being unanswered due to the upcoming U.S. presidential election and uncertainty surrounding COVID, many experts believe the stock market will have high levels of volatility at least in the short term.

- For direct investment, economic uncertainty is likely to lead business leaders to invest in “large, more stable markets with more predictable political and regulatory structures.”

- Wells Fargo suggests that investors should be looking at long term investments rather than short term, which will lessen the impact of market volatility. The specific recommendations are long-term diversification, rebalancing, and focusing on quality.

- Fidelity is making recommendations to weather the economic uncertainty that include multi-asset income strategies, high-yield bonds, and dividend-paying stocks.

2. Big Government

- Multiple firms/experts in the investment space are predicting the return of big government, partially as a result of the COVID pandemic. These include B of A Securities, Hartford Funds, Bloomberg, and Invesco. The link for Invesco is being shared directly here as their website setup does not allow for a direct link: https://www.invesco.com/apac/en/institutional/insights/market-outlook/as-us-virus-cases-grow-so-does-the-case-for-big-government.html

- One potential negative outcome for investors is that as governments become more involved in business, the rights of shareholders may decline as stakeholders are given more power.

- The pandemic has also shown that consumers are willing to trade their privacy for their safety, with more than 30 countries openly tracking their residents. Companies producing the technology to facilitate improved consumer safety are likely to benefit from this shift.

- Business Wire reports several possible market implications related to the shift to big government, including: (1) bond markets could have low volatility and flat yields; (2) government effectiveness will determine growth; (3) investors will need to identify governments that are “able to maximize trend growth;” and (4) there could be advantages for corporations with government support.

- Each country will need to be examined individually by investors as the particular status of each country will largely be determined by how effectively they have controlled the pandemic. This can be seen in the Invesco link provided above.

- The impact of government money being poured into the private sector can be seen by the stock market boosts that have occurred anytime it appears another stimulus may be near.

- Big government will generally result in increased debt for governments, which impacts investors. Although nothing can be predicted with certainty, in times of large government spending equity markets become more attractive. In addition, treasury bills can be an effective strategy when diversifying. However, yields will generally be low on treasuries and investors will have to examine index funds carefully to be sure they aren’t investing more than they like in the government backed instruments.

- According to Jodie Gunzberg, chief investment strategist at Graystone Consulting, “The path of inflation will likely have an effect not only on the price of the services the government supports but also on cost to service the debt,” she said. “The world’s faith in the U.S. dollar as the reserve currency could come under pressure as our debt/GDP explodes. That can cause interest rates to rise, hampering the ability of governments to support their debt and consumers to borrow at low rates–essentially crowding out private debt.”

B of A Securities Report

- We have summarized the insights provided in the B of A Securities report titled ‘Covid-19 Investment Implications Series: The World After Covid Primer,’ in relation to Tech War and Gen Z. In addition, we conducted research to locate additional sources that supported the conclusions in the report.

- Much of the data included in the B of A report is based on surveying analysts representing over 3000 companies in 25 sectors.

Tech War Insights

- The report states “data is the new must need resource, meaning a resurfacing tech-war as the new geopolitical battleground. Half of our analysts expect higher IT spending than pre-COVID. We anticipate a wave of investment in new infrastructure, AI technologies and moonshot future tech.”

- B of A predicts four long term results of COVID on the tech industry: “new communication infrastructure, data generation, cloud computing power, and bandwidth.”

- Moonshot technology “such as autonomous vehicles, quantum computing, and vertical farming” may become commercialized more quickly as countries compete against each other to win the tech race.

- In the shorter term (this was not defined in the report), some activities that require tech, and that saw increased adoption during the pandemic, are likely to see more permanent adoption. These include activities such as ecommerce, working from home, and esports.

- There are also several challenges to any tech advances. Economic uncertainty is widespread and will likely impact the availability of funding. Additionally, as social distancing continues to be the norm, sharing platforms may see their business models suffering. Finally, how willing consumers are to give up privacy in order for some of these advances to happen will be determined on a country by country basis.

- About half of the analysts surveyed for this report indicated they expected tech spending to increase. Forty three percent specifically expect COVID to affect robotic/automation plans.

- The sectors that offer investment opportunities due to the move toward big government are homeland, IoT, and TIC (testing, inspection, and certification).

- Reporting by Investing.com finds that investments in Chinese tech is increasing. The country is aiming to foster “a home-grown tech ecosystem,” which could displace several U.S. firms that operate in the space.

- An article in Early Investing reports that the U.S. government is beginning to “research and develop various technologies” through CIA labs. This puts the government in direct competition with Silicon Valley, but also emphasizes how the U.S. government is making tech development a priority.

- Much of the reporting on tech wars is related to the battle between the U.S. and China. However, other countries may be forced to choose sides which will create additional issues.

- In some cases, countries are partnering in order to improve their chances of becoming dominant in a specific space, such as the partnership between the U.S. and the UK described in this article.

Rise of Gen Z Insights

- With regard to Gen Z, the report states “Gen Z is uniquely prepared for the new era of social distancing, the online world, and sustainability.”

- Gen Z already embraces many of the consumer habits that have become more common in the COVID era, including streaming, social media, and ecommerce. As older generations start to adopt these behaviors in larger numbers, the addressable market for tech products will grow.

- Boston Consulting Group reports that as the youngest generational cohort, behaviors adopted by Gen Z during the pandemic are very likely to become long term habits and behaviors. For example, 62% of Gen Z and millennials have increased the amount of time they spend on social media, 59% have increased gaming time, and 70% have increased time spent video streaming. In all cases, these numbers are larger than the increases reported by older generations.

- Additionally, 33% of Gen Z and millennials have increased online spending. This increase is spending is due to moving to online retailers for items they previously bought in store, and also frequenting digital only retailers.

- The following chart shows what consumption is predicted to look like for the two youngest generations post-COVID.

- While all consumers have been switching brands during the pandemic (36% have tried a new brand), Gen Z are the generational cohort that is most open to doing so.

- Gen Z is also the group that is most likely to focus their shopping on essentials and reduce spending on non-essentials.

- One study published in June 2020 found that the pandemic had reinforced many of Gen Z’s core values, including “their cautious approach to spending, their aspirations for a more just world and their optimism.”